How to Summarize a YouTube Video Using VideoSeek

Example: “ACCOUNTANT EXPLAINS – How to Change Your Finances in 6 Months”

Short Summary from VideoSeek AI

This video presents a practical and clear six-month financial plan designed to help viewers achieve financial freedom without needing a six-figure income. The host, a qualified accountant and former investment banker, emphasizes that mastering money management—making money work for you—is more important than earning a huge salary. The plan guides viewers through calculating core financial numbers, saving essential expenses, managing and prioritizing debt, building an emergency fund, starting investments early, increasing income streams, andating finances to avoid decision fatigue. The approach combines behavioral insights with actionable steps, empowering viewers to break free from living paycheck to paycheck and build lasting wealth through disciplined, simple, and sustainable habits.

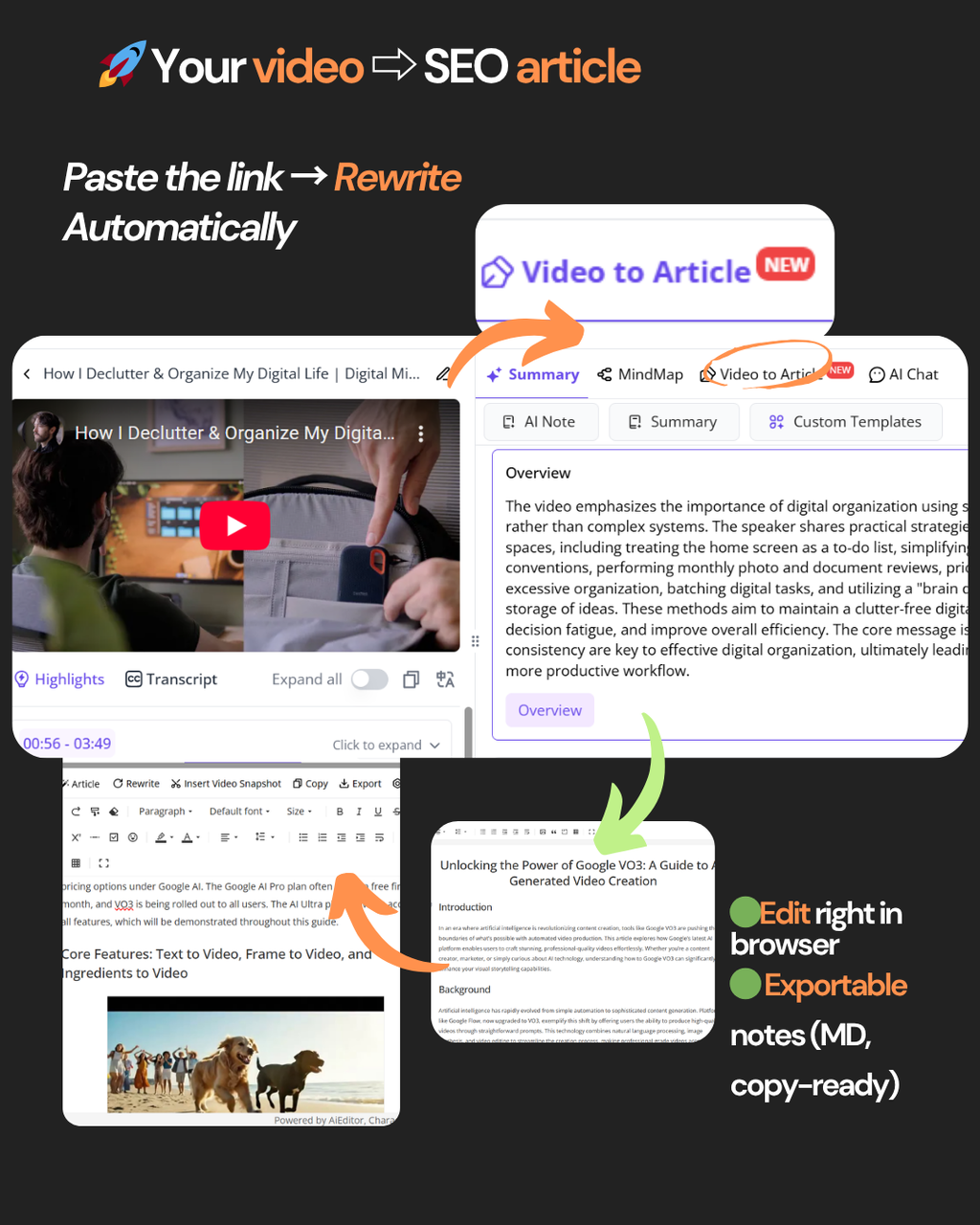

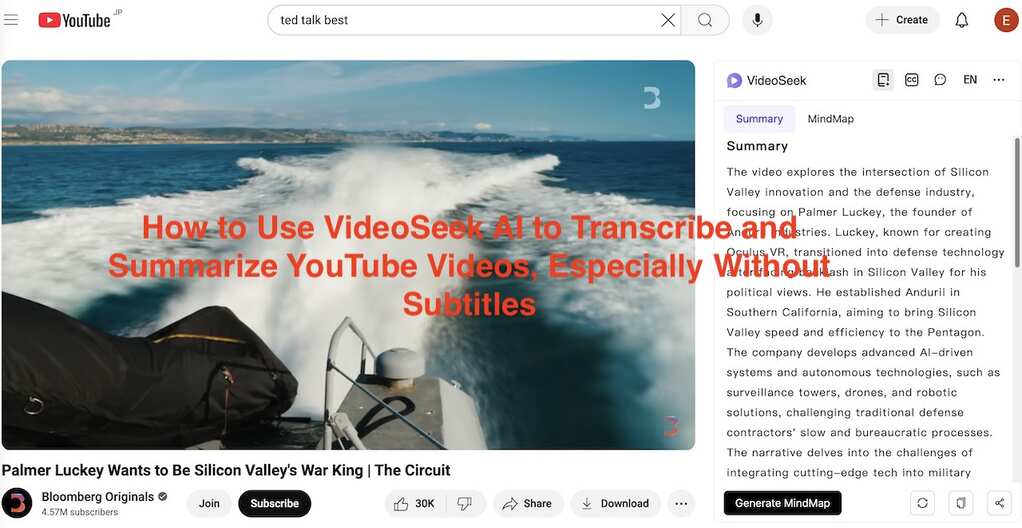

How to Use VideoSeek to Summarize the Video

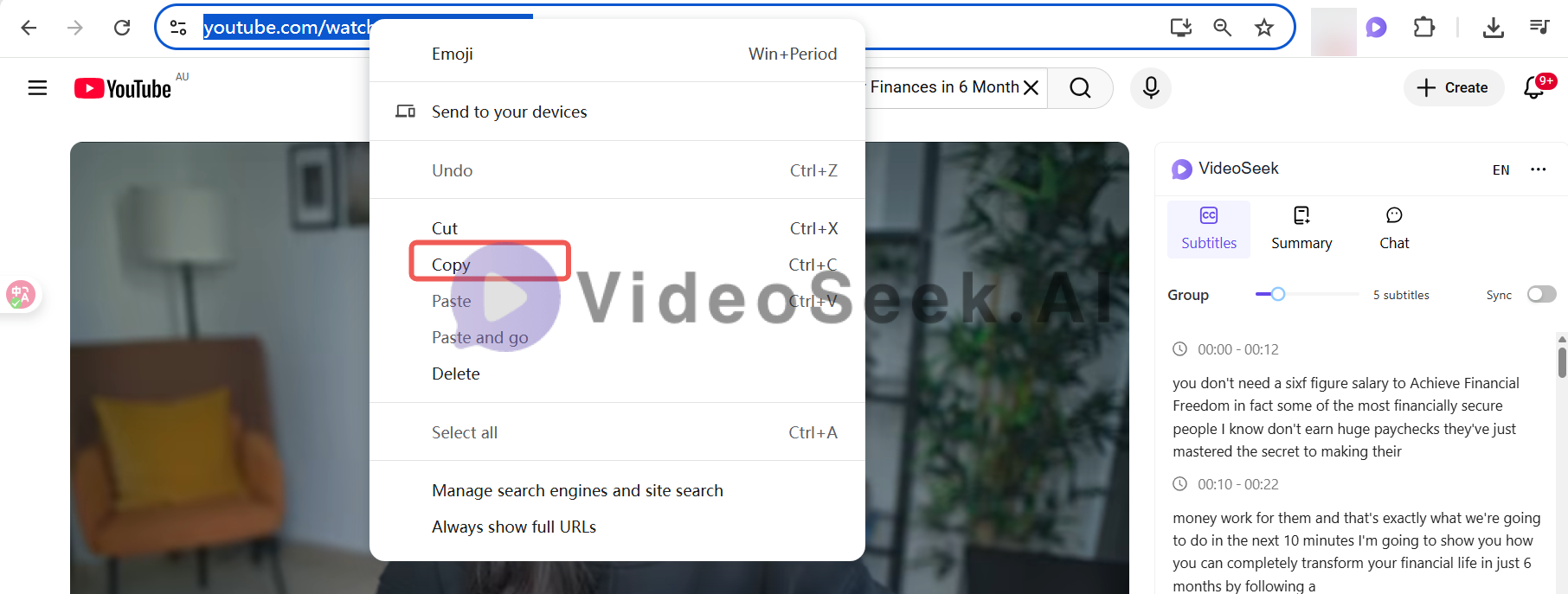

1. Copy the YouTube Link I started by finding the video you choose on YouTube and copied its URL.

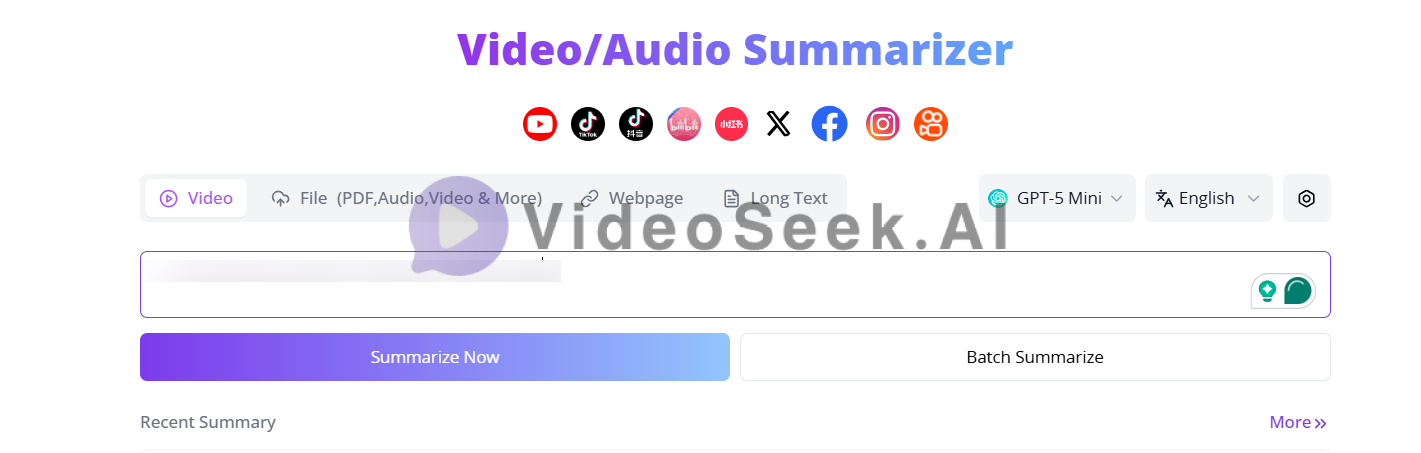

2. Pasted It into VideoSeek I opened VideoSeek, pasted the link, and clicked “Summarize Now.” Within seconds, VideoSeek generated a structured summary highlighting the main sections, action steps, and key insights.

3. Reviewed and Edited the Summary Using the built-in editor, I refined the summary and organized the content into months, matching the plan described in the video.

The 6-Month Plan Extracted with VideoSeek

Month 1 – Know Your Numbers (Stop Avoiding!)

Calculate your net income (after tax), basic expenses (rent, food, transport), savings or investment goals, and discretionary spending. Facing reality is the first step.

Month 2 – Save One Month’s Essentials

Goal: save an amount equal to one month of basic expenses. Cut ruthlessly, subscriptions, dining out, unnecessary spending.

If you can’t reach it in one month, take two or three, but start immediately.

Month 3 – Pay Off High-Interest Debt & Build a Safety Net

- Attack Debt: Focus on anything above 8% interest (credit cards, payday loans).

- Build an Emergency Fund: Save 3–6 months of essential expenses. Use a high-yield savings account.

Month 4 – Start Simple Investing & Keep Saving

- Employer Match: Max out any retirement contributions.

- Tax-Advantaged Accounts: ISAs (UK), Roth IRAs/401(k)s (US).

- Invest Simply: Choose low-cost, broad-market index funds or ETFs (e.g., S&P 500). Suggested ratio: 70% savings / 30% investing to start.

Month 5 – Boost Your Income

- Evaluate Your Job: Ask for a raise or find a role with better pay or growth.

- Start a Side Hustle: Even $200–$300 a month makes a big difference.

Month 6 – Automate & Optimize

- Automate Everything: Set up automatic bill payments and transfers to savings or investment accounts.

- Review Regularly: Adjust your plan as income and goals evolve.

Key Insights from the Video (via VideoSeek)

- Awareness is the foundation — know your numbers.

- Saving creates freedom and future choices.

- Prioritize eliminating high-interest debt.

- Start investing early and simply — time beats timing.

- Increase income alongside smart budgeting.

- Automate for consistency.

- Stay flexible — your plan should adapt over time.

The Bottom Line

Financial freedom doesn’t come from a high salary but from disciplined, consistent action. This six-month plan—extracted through VideoSeek AI, lays out a clear roadmap: understand, save, eliminate bad debt, invest wisely, earn more, and automate.

Summary Source:

This overview was created using VideoSeek AI, which quickly analyzes long-form YouTube content to extract structured summaries, action plans, and key ideas.

With just a few clicks, copying a link, pasting it into VideoSeek, and reviewing the result, you can turn hours of video into clear, actionable insights.

Video Resource: https://www.youtube.com/watch?v=7XVmhedNiIQ