Video Summary: 6-Month Plan to Transform Your Finances (via VideoSeek AI)

Introduction

Imagine checking your bank account and, instead of that sinking “end-of-the-month” feeling, you see savings growing, debt shrinking, and investments quietly compounding. No lottery win, no overnight success, just a clear plan that turns chaos into control in half a year.

Most money advice says “earn more.” But in a video I summarized, a qualified accountant and former investment banker showed that the real key is making money work for you. Her six-month plan is simple, structured, and achievable for almost anyone.

The core message: financial freedom comes from managing money wisely, not just earning more.

Here's the actionable 6-month plan extracted:

Month 1: Know Your Numbers (Stop Avoiding!)

Calculate your Net Income (after tax), Basic Expenses (rent, food, bills, transport), Future Savings/Investment target, and Discretionary Spending. Facing reality is crucial.

Month 2: Save One Month's Essentials

Goal: Save an amount equal to your Month 1 basic expenses. Cut ruthlessly (subscriptions, dining out).

If impossible in one month, take 2-3 months, but start immediately.

Month 3: Crush High-Interest Debt & Start Your Safety Net

1.Attack Debt: Prioritize debts with interest rates over 8% (credit cards, payday loans). Pay highest rates first.

2.Build Emergency Fund: After high-interest debt, save 3-6 months of basic expenses (3 for stable income, 6 for unstable). Store in a high-yield savings account.

Month 4: Start Simple Investing & Keep Saving

1.Grab Free Money: Max out any employer retirement match.

2.Use Tax-Advantaged Accounts: ISAs (UK), Roth IRAs/401(k)s (US).

3.Invest Simply: Use low-cost, broad-market index funds or ETFs (e.g., S&P 500 tracker).

* Balance: Aim for a 70% savings (emergency fund) / 30% investing split initially.

Month 5: Boost Your Income

1.Evaluate Job: Seek a raise, promotion, or higher-paying role if it doesn't offer learning/earning.

2.Side Hustles: Freelance, monetize a hobby. Even $200-$300/month extra accelerates progress.

Month 6: Automate & Optimize

1.Automate Everything: Set up direct debits for bills and automatic transfers to savings/investment accounts. This reduces errors and decision fatigue.

2.Review Regularly: Adjust your plan quarterly/bi-annually as income, expenses, or goals change.

Key Takeaways from the Video:

- Awareness First: Knowing your numbers is essential.

- Saving = Freedom: It buys future security and choice.

- Debt Strategy: Eliminate high-interest (>8%) debt aggressively.

- Invest Early & Simply: Leverage compound interest with diversified funds. Time is key.

- Increase Income: Essential alongside smart spending.

- Automate: Ensures consistency and discipline.

- Stay Flexible: Your plan must evolve.

The Bottom Line:

Financial freedom is achievable through systematic action, not just a high salary. This 6-month framework provides the roadmap: understand, save, eliminate bad debt, invest simply, earn more, and automate.

*Summary Source:

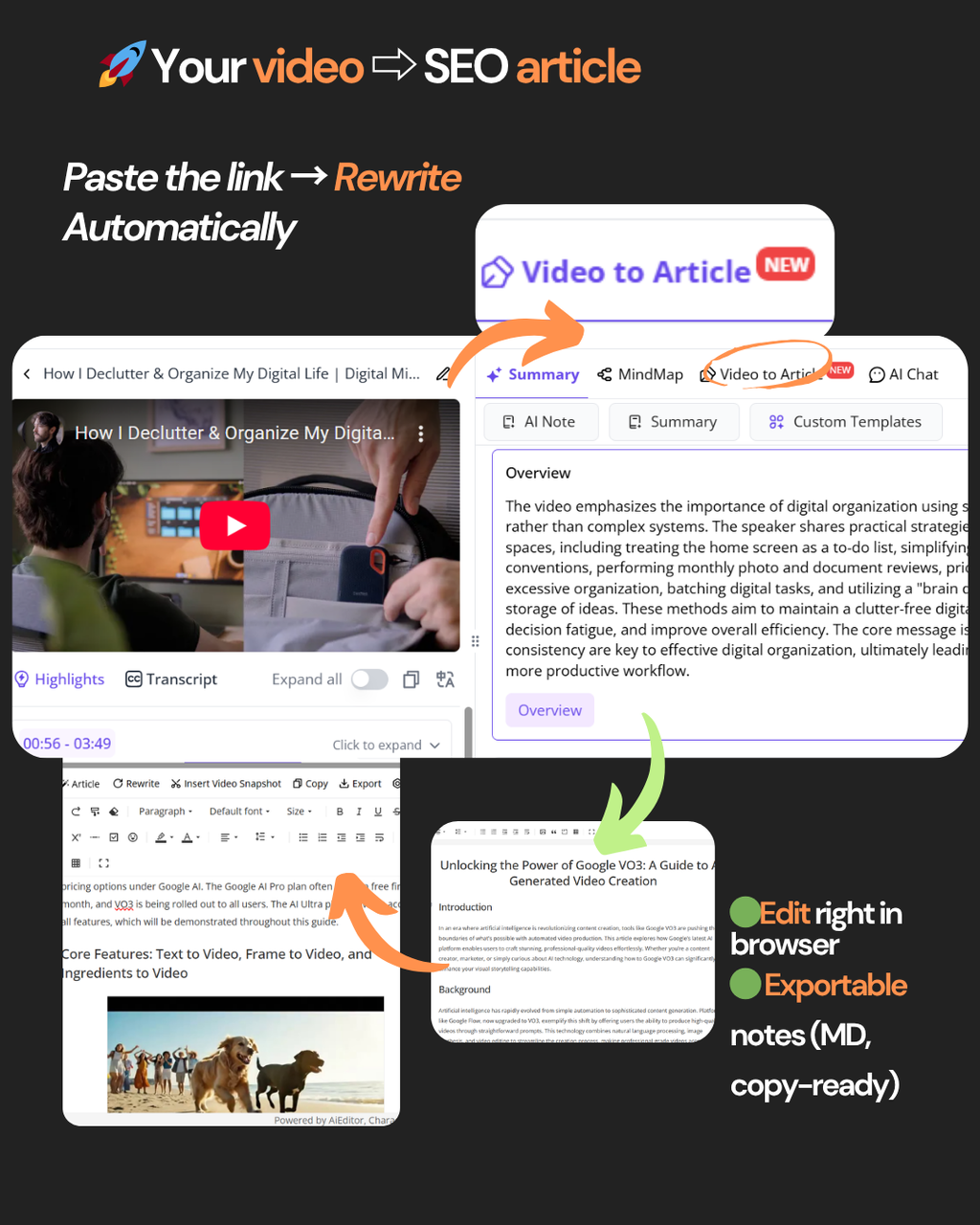

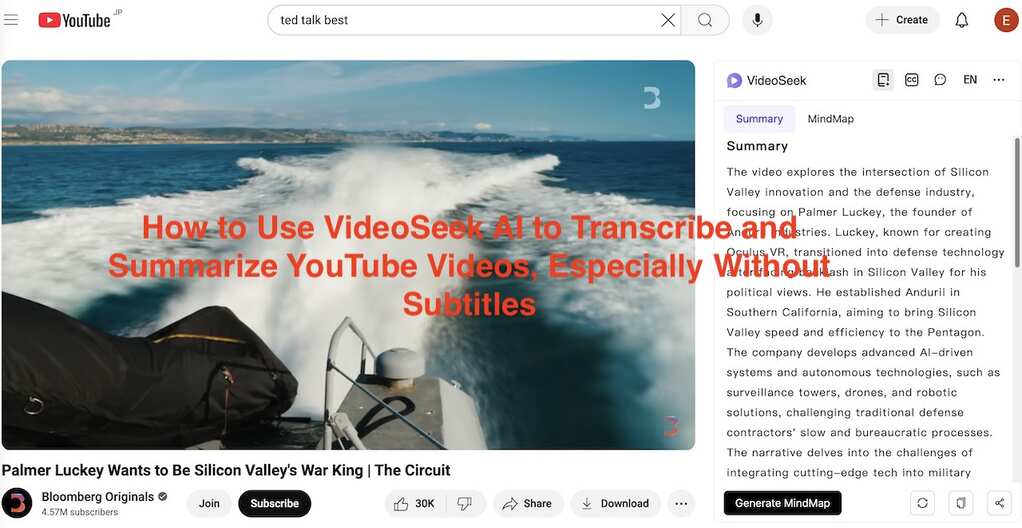

This concise overview was extracted using Videoseek AI from the video "ACCOUNTANT EXPLAINS: How to Change Your Finances in 6 Months". Videoseek AI quickly identifies core structures, actionable steps, and key insights from long-form video content.